BIMCO: Trade Restrictions Continue to Drive Tanker Demand Higher

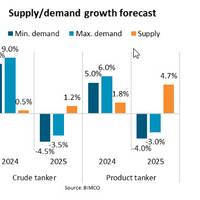

Crude tanker demand is forecast to outpace supply in 2024 but grow slower than supply in 2025 as ships may return to the Suez Canal and sailing distances shorten, according to BIMCO’s May issue of its Tanker Shipping Market Overview & Outlook.Driven by increasing sailing distances, product tanker demand is also expected to grow faster than supply in 2024 but slower in 2025. A tightening supply/demand balance should result in increases in rates and prices in both markets in 2024…

Gall Thomson Confirms Known 2023 Marine Breakaway Couplings Activations

Gall Thomson has revealed there were 16 known activations of its Marine Breakaway Couplings during 2023. The activations occurred in nine different countries around the world.On each occasion, the Marine Breakaway Coupling (MBC) operated exactly as expected. Oil spills, injuries and damage to assets such as vessels, hoses or facilities was avoided. There were no known spurious activations reported.Gall Thomson MBCs are designed to activate in an emergency during offshore hose…

WinGD to Supply Engines for AET’s Ammonia-Fueled Aframax Tankers

Swiss marine power company WinGD has secured an order for its X‑DF‑A ammonia-fueled engines for what will be the world’s first ammonia dual-fuel Aframax tankers.Two vessels ordered by Singapore based ship owner and operator AET, a petroleum arm of Malaysia’s MISC Group, will be built at Dalian Shipbuilding Industry with six-cylinder X62DF-A engines, the newest addition to WinGD’s clean-fuel engine portfolio.AET recently entered into time charter party (TCP) contract with Petronas'…

MISC Signs Deals for World’s First Ammonia Dual-Fuel Oil Tankers

Malaysia’s MISC Group has entered into time charter party (TCP) and shipbuilding contracts for the development of world’s first two ammonia dual-fuel Aframax oil tankers.The TCP contract has been signed with Petronas' PETCO Trading Labuan Company (PTLCL), through MISC Group's petroleum arm AET.Using these vessels, PTLCL will be able to transport its products to customers around the world while contributing to the industry decarbonization by utilizing ammonia as the cleaner alternative…

EU Tanker Import Tonne Mile Demand up 12%

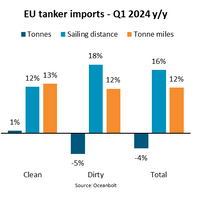

In 2023, sanctions on Russian oil exports by the EU caused a major shift in tanker trades and a 10% increase in average sailing distances for EU tanker imports. Now, attacks on ships in the Red Sea area have caused average sailing distances to increase a further 16% and tonne mile demand to increase 12% despite falling volumes, says Niels Rasmussen, Chief Shipping Analyst at BIMCO.During the first quarter of 2024, tanker import volumes to the EU fell 4% year-on-year due to a 1% increase in the clean tanker trade but a 5% fall in the dirty tanker trade.

Shipping Companies Turn to Longer-Term Leases as Tanker Supply Tightens

Rising oil tanker chartering rates due to global shipping disruption are forcing oil shippers to take on longer-term shipping charters, executives said this week at an energy conference in Houston.The global oil tanker fleet must now travel further to get crude to refineries and fuel to consumers. European sanctions have forced Russian exporters to send oil to Asia that would have otherwise gone to Europe. Attacks on vessels in the Red Sea have forced some shippers to sail around…

Reliance Refusing Sovcomflot Oil Shipments

India's Reliance Industries, operator of the world's biggest refining complex, will not buy Russian oil loaded on tankers operated by shipping company Sovcomflot (SCF) after recent U.S. sanctions, according to two sources familiar with the matter.The development adds to oil export problems for Russia as its oil firms may face difficulties finding ships to sell surplus oil after recent Ukrainian drone attacks on the state's refineries. Russian companies are already struggling to collect payments for oil exports due to banking restrictions.The U.S.

BIMCO: Tanker Supply/Demand Balance will Tighten

The BIMCO Tanker Shipping Market Overview & Outlook February 2024 by Niels Rasmussen, BIMCO’s Chief Shipping Analyst, forecasts that the supply/demand balance will tighten further during both 2024 and 2025.Low fleet growth, along with increasing sailing distances, create the foundation for the improvement despite a slowing of growth in oil demand. The product tanker supply/demand balance is also expected to tighten in 2024 but weaken in 2025. Like the crude tanker market, longer sailing distances support demand growth despite slowing oil demand.

Hanwha Ocean Secures $258M Order for Two VLCCs

South Korean shipbuilder Hanwha Ocean has received an order to construct two very large crude carriers (VLCCs) for a shipping company in Oceania.The order for VLCCs, worth $257.8 million (342 billion won), is the first such order for Hanwha Ocean in the last three years. This is also the highest price for the vessels in 16 years, since the 2008 global financial crisis, the company said.The ships will be built at the Geoje plant and delivered to the shipowner in the first and second half of 2026…

Lithuania Probes Baltic Sea Oil Spill

Lithuania said on Thursday it had been informed by a subsidiary of Polish oil refiner Orlen PKN of an oil spill in the country's waters in the Baltic Sea and had launched a probe into the incident.Lithuania's Environmental Protection Department said in a statement the subsidiary, Orlen Lietuva, had informed it on Wednesday of a 300-litre spill near the Butinge oil import terminal in connection with the loading of a tanker.It said an inspection by Lithuania later on Wednesday showed the spill measured nine kilometers by two kilometers with at least 1.8 tonnes of oil on the surface…

Oil Rises after Houthi Attack on Ship

Oil rose on Tuesday as an attack by the Iran-aligned Houthis on a chemical tanker escalated geopolitical tension in the Middle East, though concerns over excess supply and slowing demand kept a lid on gains.A cruise missile launched from Houthi-controlled Yemen struck a commercial chemical tanker, causing a fire and damage but no casualties in the latest such attack to heighten safety risks for tankers in vital shipping lanes.Brent crude futures LCOc1 for February rose 21 cents, or 0.3%, to $76.24 a barrel by 0915 GMT, while U.S.

AD Ports Expands Shipping Operations in Kazakhstan

AD Ports Group in collaboration with KazMorTransFlot (KMTF), the national shipping company of Kazakhstan, has announced the acquisition and commencement of operations of two tankers designed for the transportation of Kazakhstan's oil across the Caspian Sea.The two oil tankers were named Liwa and Taraz - after ancient cities in the UAE and Kazakhstan, respectively, and have been acquired under AD Ports Group’s joint venture with KMTF - Caspian Integrated Maritime Solutions (CIMS).The two vessels represent a combined investment of USD35 million…

EU to Ban Sale of Tankers to Russia to Curb Shadow Fleet Growth

The European Commission is proposing to ban the sale of tankers for crude oil and petroleum products to Russia to prevent Moscow bypassing western sanctions on Russian oil with a shadow fleet of ships, a proposal by the Commission showed. The proposal, discussed on Friday by ambassadors of EU governments, also says that sales of tankers to a third country should include contractual clauses that ships cannot be re-sold to Russia or used to carry Russian crude oil or petroleum products that avoid western price caps - in the case of crude oil of $60 per barrel.

Vitol Hires Ship to Load Venezuela Crude for China after U.S. Lifts Sanctions

Vitol, the world's largest independent oil trader, has provisionally chartered a supertanker to load oil from Venezuela for China, according to two shipbrokers and data from shiptracking firms Kpler and Vortexa.The Very Large Crude Carrier Gustavia S., chartered for $11 million, is scheduled to load its cargo between Nov. 27 and Dec. 2, according to the sources.The company declined to comment on the issue.Vitol is among major European trading houses seeking to resume trade in Venezuelan oil after Washington in mid-October issued a general licence lifting…

Venezuela's PDVSA Offers Corocoro Crude Cargo through Intermediary

Venezuela's state-run oil company PDVSA is offering to sell up to 1 million barrels of Corocoro crude through an intermediary, sources said on Wednesday, which could become the first sale of that grade in two years.Since Washington temporarily eased oil sanctions on the country last month, PDVSA has been allocating spot cargoes of crude and fuel oil through little known firms that contract with trading companies, which ultimately deliver to refiners. PDVSA and Italy's Eni ENI.MI…

Denmark Could Block Tankers with Russian Oil from Reaching Markets - FT

Denmark will be tasked with inspecting and potentially blocking tankers carrying Russian oil through its waters under new European Union plans, the Financial Times reported on Wednesday, citing three unidentified sources.Russia sends about a third of its seaborne oil exports, or 1.5% of global supply, through the Danish straits so any attempt to halt those supplies would send oil prices higher and trigger a confrontation with Russia. The FT said that Denmark would target tankers carrying Russian oil that did not have Western insurance…

Euronav Doubles Q3 Core Profit Yr/yr; Beats Estimates

Belgian oil tanker firm Euronav on Thursday beat analysts' expectations and more than doubled its core profit in the third quarter from the same year-ago period, helped by higher sales and high freight rates.The market for very large crude carriers (VLCC) "has improved due to increased frequency of loadings from higher USA crude production", Euronav said in a statement. Although freight rates fell modestly during the quarter, they still remained strong when compared to historic averages since 1990, Euronav added.

World's Ghost Fleet in Focus Over US Russian Price Cap Crackdown

U.S. penalties on shippers transporting Russian oil in breach of the G7's price cap could push more Russian cargoes onto vessels referred to as the ghost fleet and away from mainstream tankers, shipping sources and analysts told Reuters.The cap bans Western companies from providing maritime services for Russian seaborne oil exports sold above $60 a barrel.It was designed to keep oil flowing to markets while reducing Russia's energy earnings that it can use to finance its war on Ukraine…

Oil Tanker Hit by US Sanctions Heads to Texas for Unloading - Exxon

An oil tanker that the U.S. government imposed sanctions on for recently carrying Russian oil above the Western price cap is proceeding to the Baytown refinery in Texas for unloading, Exxon Mobil said on Tuesday.Exxon, the current charterer of the Yasa Golden Bosphorus, was not targeted by the sanctions last week since the oil producer chartered the tanker months after it had carried and offloaded Russian oil, a price cap coalition official after the U.S. imposed the sanctions on the tanker.The unloading by Exxon has been authorized by the U.S. Treasury Department's Office of Foreign Assets Control, the company said in a statement. The deliveries are certified products of Canadian origin, according to Exxon.The U.S.

Tanker Hits Mine in Black Sea

A Liberian-flagged oil products tanker hit a mine on Sunday in the Black Sea off the coast of Romania and sustained minor damage, but the crew was safe, sources said on Monday.It is the second vessel this month to have been hit by a floating mine in the Black Sea, in a reminder of the continued perils faced by commercial ships in the region.The Ali Najafov tanker was sailing near to the Sulina channel near Romania when the blast occurred on Sunday, Yoruk Isik, head of the Bosphorus Observer consultancy, told Reuters.A Ukrainian source separately confirmed the vessel had struck a mine.The vessel's Istanbul-based manager Palmali, listed in shipping databases, did not immediately respond to a request for comment.

Growing Tanker Fleet, Cheaper Freight Challenge Russian Oil Price Cap

Russian crude oil producers are enjoying the cheapest costs to ship to refiners in China and India in almost a year thanks to a growing number of vessels plying the routes, according to trading and shipping sources.The arrival of new shippers working outside the purview of Western governments allows Russian firms to earn more than the $60 per barrel cap that the U.S. and its allies had aimed to impose on Russia through sanctions. It also means that enforcing the price cap will have a limited impact on Russian revenues.On Thursday, the U.S. imposed the first sanctions on owners of tankers carrying Russian oil above the cap, one based in Turkey and one in the United Arab Emirates…

Euronav Says Shareholders CMB and Frontline Reach Deal on Acquisition

Belgium's Euronav on Monday said that its two major shareholders CMB and Frontline have reached a deal that would see CMB take control of the oil tanker company and buy its remaining shares.The deal ends uncertainty over Euronav's future, after peer Frontline - controlled by Norwegian-born shipping tycoon John Fredriksen - in January scrapped a $4.2 billion merger plan that would have created the world's largest publicly-listed tanker company.That decision had led Euronav to launch arbitration action against Frontline.

Euronav Says CMB Offers to Buy 26% Stake, Shares Surge

Euronav second shareholder Compagnie Maritime Belge (CMB) is offering to acquire Frontline's 26.12% stake in the company for $18.43 per share, which will be followed by a mandatory public offer at the same price, the Belgian oil tanker and storage operator said on Thursday.Shares of Euronav, which were suspended earlier in the day after spiking on media reports about the company going private, jumped around 18% as trading reopened at 1330 GMT.The completion of the deal would end the arbitration action started by Euronav against its peer Frontline…