GMS

GMS News

GMS: Firming Demand for Alang Recyclers

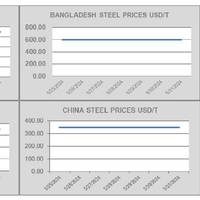

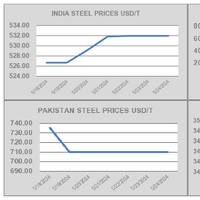

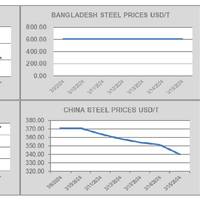

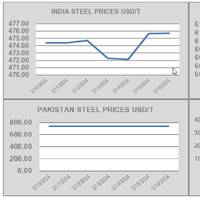

As May comes to an end, increasing vessel prices on the back of a firming demand from Alang recyclers has now seen local steel plate prices climb nearly $45/ton, reports cash buyer GMS.“Notwithstanding, an all too familiar lack of decent quality tonnage available to global recyclers to sink their teeth into, remains blisteringly omnipresent as the industry ventures into the traditionally quieter monsoon months and freight sectors appear to be performing firmly once again…

Ship Recycling Market Firming Up

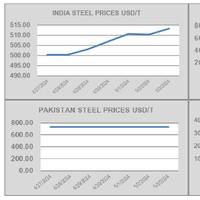

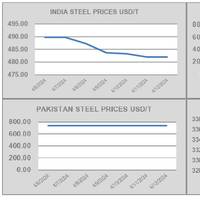

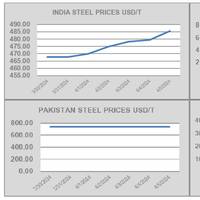

As the summer / monsoon months creep closer, ship recycling markets in Turkey and the Indian sub-continent have been firming over recent weeks, reports cash buyer GMS.“Pakistan, though still relatively firm, feels sluggishly satiated of late having taken in a healthy collection of vessels / LDT (for this market’s size).” Despite having bested last year’s recycling volumes with another three fresh arrivals this week…

GMS: Ship Recycling Market Quiet and Stable

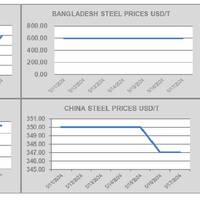

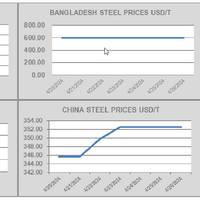

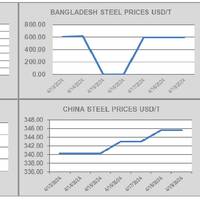

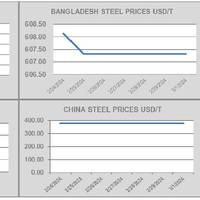

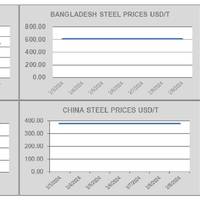

Following on from last week’s unexpected shock via the intentional depreciation in the value of the Bangladeshi Taka, it has been an altogether quieter week of sales and activity in the country, says cash buyer GMS.Domestic ship recyclers are evaluating the potential costs and implications of further depreciations, given that the Taka slipped further into BDT 117 territory against the U.S. Dollar this week.

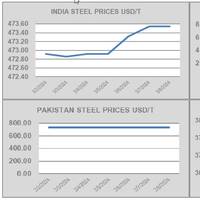

GMS: Bangladesh Recyclers Likely to Lose out to India

Towards the end of the working week, the Bangladeshi Taka crashed by about 6.4% against the U.S. dollar in a couple of days. This depreciation in the Taka will translate into higher L/C costs that should escalate by about 6% - 7% (at least), reports cash buyer GMS.This will further reduce already suffocated margins that have resulted from flatlining steel plate prices, ensuring that upcoming vessel acquisitions will be more expensive for local recyclers…

Ship Recycling Activity Climbs in Week 18

Activity across the Indian sub-continent ship recycling markets has been climbing on the back of recently witnessed agitations in the trading lanes, reports cash buyer GMS.“A growing number of Ship Owners are biting the recycling bullet and selling their overaged but still trading vessels. Containers have been the first segment to be squeezed out by this recent dip in freight rates as several units were (and continue to be) introduced for a recycling sale…

Sudden Influx of Tonnage to Ship Recyclers

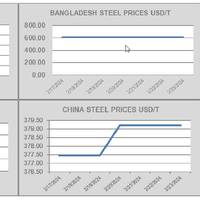

On the back of freight markets that are finally facing their first set of 2024 jitters, the industry is gradually witnessing an increasing number of units being proposed for a recycling sale, all of which are being confirmed via the sudden influx of tonnage at the Indian and Bangladeshi waterfronts this week, reports cash buyer GMS.This coms just as the Pakistani market (as expected) starts to fall behind on its domestic arrivals.

Ship Recycling Markets Face Varied Fundamentals

This week, various holidays concluded across the globe just as Indian sub-continent ship recycling markets started to perk up amidst fundamentals that have independently enjoyed varying degrees of volatility and resurgence over recent weeks, reports cash buyer GMS.“Steel plate prices in Bangladesh and Pakistan remained flatlined at respectively firm levels - the effects of which has only helped these…

Sustainable Ship Recycling Program Celebrates 500 Free Safety Awareness Sessions

The Sustainable Ship and Offshore Recycling Program (SSORP) has announced the successful completion of its 500th free safety awareness session at ship recycling yards across the Indian subcontinent.The milestone underscores SSORP's firm commitment to elevating safety standards and promoting sustainable practices within the ship recycling industry.Over 20 unique topics have been addressed in these sessions…

Ship Recycling Resurgence Greater Than Expected

Indian sub-continent ship recycling markets enjoyed a greater than expected degree of a post-Ramadan resurgence, reports cash buyer GMS.“Vessel prices across the various destinations seemed to have concurrently enjoyed varying degrees of an uptick this week on the back of which some eye-opening sales were seemingly concluded into the various sub-continent locations.”However, this firming is certainly surprising…

A Few Surprise Sales This Week in Ship Recycling

Ship recycling has again been quiet across the ship recycling globe, reports cash buyer GMS.“Moreover, as an increasing number of vessels past beached have been nearly recycled, and barely any meaningful arrivals have been reported at the respective waterfronts (zero in India this week), frustrated industry players are just … going with the depressive flow,” states GMS.“With that being said and reportedly this week…

Scarcity of Ship Recycling Tonnage Continues

Despite the occasional smaller LDT candidate popping up for sale over recent weeks, there regrettably remains the ongoing scarcity of tonnage that is simply unable to fill the most basic of demands at the major ship-recycling destinations, reports cash buyer GMS.“As plots across Indian sub-continent markets gradually recycle through their respective shares of vessel deliveries through the first quarter of 2024…

Bangladesh and Pakistan Ship Recycling Markets Remain Steady

With the conclusion of week 11, the ongoing and seemingly endless dearth in the supply of viable candidates has been mercifully keeping the Bangladeshi and Pakistani ship recycling markets steady, reports cash buyer GMS.“On the other hand, the Turkish and Indian markets continue to endure their respective shares of a notably trying time, given that the Turkish Lira continues to plummet even amidst…

Sleepy Week for Ship Recyclers

Even though the Indian sub-continent ship recycling markets have taken on a collection of smaller vessels of late, the week remains “sleepy” says cash buyer GMS.Virtually no deals have been concluded, and this has put the squeeze on the global ship recycling sector.“Dry bulk charter rates have been pushing on by the week as ship owners monetize the most from this sector. Containers and tankers too remain oddly off the recycling buffet…

Recycling Market Still Deprived of Tonnage

As freight markets push further on, global ship recycling markets remain deprived of tonnage, making it an increasingly suffocating environment for ship recyclers to operate in, reports cash buyer GMS.Bangladesh and Pakistan rely heavily on imported ship’s steel, not only for domestic / large-scale infrastructure projects, but also for its comparatively ‘healthier’ and ‘rust-free’ condition than other forms of imported scrap metal / steel (HMS 1…

Ship Recycling Market Faces Tonnage Shortage

Global ship recycling markets are now being exclusively driven by the relentless and futile shortage of tonnage that is expected to continue until Spring (at the very least), says cash buyer GMS.“The much-anticipated rebound in global recycling volumes that so many in our industry had been waiting (hoping) for before the turn of the year, has unfortunately failed to materialize.”Markets in Turkey and India remain well off the competitive pace…

GMS: Ship Recycling Market Still Slow

Despite Chinese new year holidays concluding on Friday, a pervading theme of an unrelenting dearth in the overall availability of tonnage across global ship recycling markets has been enduring for several quarters now, says cash buyer, GMS.This has resulted in another dreary week of market inactivity and silence across all recycling destinations.Charter rates continue to remain artificially elevated (especially) in the dry bulk sector…

Call for IMO to Resolve Inconsistencies in Ship Recycling Conventions

BIMCO, Bangladesh, India, Norway, Pakistan and the ICS have submitted a paper ahead of the 81st Marine Environment Protection Committee (MEPC) meeting on March 18-22 that highlights the need to resolve possible conflicts between the Hong Kong Convention and the Basel Convention.The Hong Kong Convention will enter into force on June 26, 2025, and the co-signatories of the paper ask for clarification…

Subcontinent Ship Recycling Market Remarkably Quiet

Despite the Pakistani & Bangladeshi markets stabilizing and displaying a far greater aggression at the bidding tables over the last five weeks, it has been a remarkably quieter start to 2024 for ship recycling than many had anticipated, says cash buyer GMS.With Houthi attacks, trading markets have remained unseasonably firmer, thereby delaying the historical ‘post-New Year aggression’ from the sub…

Ship Recycling Market Impacted by Middle East Situation

Bangladeshi and Pakistani markets have been making noticeable improvements over recent weeks, but there remains an ongoing shortage in the global availability of ‘market’ tonnage for ship recycling, reports cash buyer GMS.As evident from the number of arrivals and beachings this week, an increasing number of ship recyclers have clearly managed to and are reportedly still in the process of obtaining further approvals on L/Cs from their respective banks.

Ship Recycling: Few Sales Confirmed

In its Week 3 market report, cash buyer GMS says that even as vessel prices have improved from the lows seen towards the end of 2023 and plate prices made a massive jump in Bangladesh over the last couple of weeks, only a trickle of sales have been confirmed into the recycling markets in 2024 thus far.“There also seems a reluctance from ship owners to bite at current offers in the low USD 500s/LDT, having seen levels around USD 100/LDT higher only a couple of quarters ago.