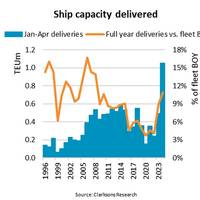

Container Ship Deliveries Hit YTD Record

“In 2023, 2.3 million TEU of container ship capacity was delivered, beating the former all-time high by 37%. Year-to-date another record has been set as more than 1 million TEU has already been delivered during the first four months of the year, an increase of nearly 80% compared to the previous record,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.As ship recycling has so far only retired 19 smaller ships, the fleet has expanded by nearly 1 million TEU, a 3.5% increase compared to the beginning of the year.

Jolly Rosa Enters the Messina Fleet

Genoese group Ignazio Messina & Co.has been taken delivery of the container vessel Jolly Rosa. Flying the Italian flag and enrolled in the International Registry at the Genoa Port Authority, the ship measures 260 x 32m with a gross tonnage of 42,112 tonnes and a transport capacity of 4387 TEU containers, 360 of which are reefer. Under the command of Captain Simone Galli with a crew of 23 people, 13 of whom are Italian, 4 EU and 6 non-EU, she joins in the Messina fleet the Jolly Oro and the Jolly Argento which have been purchased and entered service for the group in recent months.

ZIM 2Q Revenues Plunge 62%

Pain in the containershipping sector is not uncommon in 2023, and Israel's ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) is no exception, today reporting 2Q and six month results:Net loss for the second quarter was $213 million, negatively impacted by a non-cash after tax item of $51 million related to the redelivery of certain vessels.Operating loss (EBIT) for the second quarter was $168 million, compared to operating income of $1,764 million in the second quarter of 2022Revenues for the second quarter were $1…

Long-Term Container Rates Fall (again)

The beleaguered carrier industry took another major hit in June, with the latest data from Xeneta’s Shipping Index (XSI) showing a decline of 9.4% in global long-term shipping rates. Following on the heels of a 27.5% collapse in May, and a 10.3% fall in April, contracted rates have now shed 47.2% of their value in the last three months alone, and 51.7% over the course of 2023.Xeneta’s data shows falls in the prices of valid long-term contracts across all key trading corridors…

“Friendshoring” Impacts Container Shipping Trade Patterns

As geopolitical upheaval continues, Peter Sand, Chief Analyst, Xeneta, explores how global trade patterns have (and will) evolve.Geopolitical unrest could have dramatic and long-term impacts on global trade patterns for all goods and commodities, as political alliances are essentially being ripped up and rewritten. Spurred by Russia’s invasion of Ukraine in 2022, changing trade patterns are emerging in the container shipping sector, said Xeneta’s Peter Sand, as the term of the day is “friendshoring”…

Record High Container Order Book Signals 'Significant Change'

“Despite the collapse in freight rates, shipowners still have an appetite for new container ship orders and the order book has continued to grow. The record high order book of 7.54 million TEU will result in significant changes to the container fleet in the coming years,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.During the last 10 quarters, 8.61 million TEU has been contracted, matching the level contracted during the preceding 30 quarters. The order book has now increased for 10straight quarters…

Emissions Winners, Losers on Far East to U.S. West Coast Trade

Xeneta returns this week with a second ranking of carrier carbon emissions, this time focused on the Far East to U.S. West Coast Trade."Why are we doing this? We want to shine a light on the importance of green shipping and spotlight the progress of carriers,” said Peter Sand, chief analyst, touting the results as "Name & Fame." Results are based on the Xeneta and Marine Benchmark Carbon Emissions Index (CEI).Name & Shame: Xeneta CEI Tool Highlights Best, Worst Enviro PerformersQ4'22…

Name & Shame: Xeneta CEI Tool Highlights Best, Worst Enviro Performers

Xeneta has taken the first step in a campaign to identify the carrier industry’s best and worst environmental performers across the world’s 13 leading shipping trades. With the help of the Carbon Emissions Index (CEI), a tool from Xeneta and Marine Benchmark, carriers have been assessed on the main Far East to South America East Coast container corridor. With first results out, Hamburg Süd is likely celebrating; Evergreen, likely not.According to the latest analysis, the CO2 emitted…

Container Carriers Brace for a 'Stormy 2023' says Xeneta

January proved to be a dramatic month for long-term ocean freight rates, with the latest data from the Xeneta Shipping Index (XSI) showing the largest ever month-on-month declines. According to the XSI, average long-term contracted rates dropped by 13.3% in January, the fifth month in a row of falling prices on the index. Xeneta warns there is little sign of change ahead in what looks set to be a challenging year for carriers.“Global demand has fallen away, congestion has eased…

NYK President Nagasawa Outlines Challenges, Priorities in 2023

In his annual New Years' address to employees, NYK President Hitoshi Nagasawa warned that while markets, particularly the containershipping market, will be more challenging in 2023 compared to the past two years, overall the group has "long anticipated that the strong tailwind would not last long," and in turn has "implemented structural reforms in the dry bulk business as well as cost reductions in various areas," to help ensure profitable operations.He cited the prolonged impact of COVID-19…

Great Ships of '22: MV George III, LNG Containership

Operating on Liquefied Natural Gas (LNG) from day one in service, the MV George III, the first of Pasha Group’s two new ‘Ohana Class’, Jones Act-qualified containerships, features a state-of-the-art engine, an optimized hull form, and an underwater propulsion system with a high-efficiency rudder and propeller. George III is the first LNG-powered vessel to fuel on the West Coast and the first to serve Hawaii. The 774-ft. Jones Act vessel surpasses the International Maritime Organization (IMO) 2030 emission standards for ocean vessels.

Analysis: Meltdown in the Container Shipping Sector Gains Speed

Facing global economic headwinds, the volume of containerized cargo movement continues to plummet, Peter Sand, Chief Analyst, Xeneta, summarizes: “It is clear that the carriers are no longer in charge, the shippers are.”Peter, it seems like the news in the container shipping sector started as a flow and has turned into a torrent. There was some data released yesterday that showed a 9.1% drop in September year on year for dry containers, and a 2.3 decline in the reefer sector.

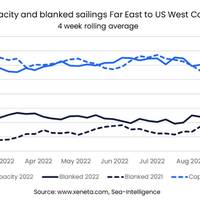

Video: Container Carrier Capacity Adjustment - Too Little, Too Late?

While drama in the container shipping sector has calmed a bit, container carriers still wrestle with unexpected drops in demand. Peter Sand, Xeneta, discusses vessel capacity moves and their likely impact on rates, as well as the first containership sent to the ship scrap yard in more than 18 months.Q: Peter, the last time that we spoke, you were succinct in saying that this market is a mess, with spot rates plunging in what traditionally is the busiest shipping season in the US. Has that picture changed in the last few weeks?Peter Sand, XenetaHas it changed from being a mess? Not really.

Collapsing Spot Rates, Falling Capacity define Far East to U.S. Container Trade

In its latest Container Freight Rate Update note, Xeneta covers the average capacity and blank sailings on the Far East to the US West Coast while we head into the not-so-traditional peak season.The average capacity offered from the Far East to the US West Coast has fallen to its lowest since February in the past four weeks. Over this period, an average of 275,000 TEU has left the Far East heading for the US West Coast, about 50,000 TEU less than the peak in early August.Compared to the same four weeks in 2021…

Rollercoaster Containershipping Rates Continue, says Xeneta

South American spot rate gap set to narrow as shippers take advantage of lower Far East to West Coast ratesThe latest ocean freight rate data from Xeneta reveals that spot rates are currently $3,700 more expensive for shipping 40-ft. containers from the Far East to the South American East Coast, compared to the West Coast corridor. This huge gap – the norm is usually around a $55 East Coast premium – has opened up since 1 July. However, shippers looking to take advantage of the disparity should move quickly…

Cargo Shippers Pressure EU for Review of Container Shipping Regulation

Ten trade organizations representing the owners and forwarders of cargo, port terminal operators and other parts of the supply chain dependent on container shipping are demanding an immediate review of European Union’s Consortia Block Exemption Regulation for the container shipping industry.The Regulation exempts container shipping lines from many of the checks and balances of EU competition law and permits them to exchange commercially-sensitive information to manage the number…

Xeneta says Long-term Container Shipping Rates to Rise Again

It’s been another bumper month for long-term contracted ocean freight rates, as the cost of securing container shipments climbed by 10.1% in June. Following on the heels of a record 30.1% hike in May, this now means rates stand 169.8% higher than this time last year, with just two months of declines in the last 18 months. Despite a degree of macro-economic uncertainty clouding the horizon, all major trades saw prices moving up, with some corridors showing significant gains.Xeneta has released the figures…

MSC Signs On with Kongsberg Digital to 'Digitalize' 500 Ships

Kongsberg Digital and MSC has signed a contract for digitalizing MSC’s entire fleet consisting of approximately 500 vessels with Vessel Insight.“This is a very important contract for MSC as making our fleet more sustainable is one of our top priorities. With Kongsberg Digital and the Vessel Insight data infrastructure we will be able to optimize our vessel operations to become more effective, sustainable, and safer. The maritime industry is facing strict regulatory requirements to cut emissions and become more sustainable…

FMC Approves $2 Million Settlement Agreement with Hapag-Lloyd

The Federal Maritime Commission approved a settlement agreement reached between its Bureau of Enforcement (BoE) and Hapag-Lloyd AG (Hapag-Lloyd) where the ocean carrier will pay a $2 million civil penalty to address alleged violations related to their detention and demurrage practices.“To restore full confidence in our ocean freight system, vigorous enforcement of FMC rules is necessary. Specifically, we must ensure powerful ocean carriers obey the Shipping Act when dealing with American importers and exporters.

Containershipping's Long-term Reefer Rates Soar to All-time Highs, says Xeneta

According to the latest crowd-sourced data from Xeneta, long-term rates for reefer containers on the key US West Coast to Far East route soared almost 60% in April.In its report Xeneta notes a surge in rates of around $2000 per 40-ft. unit after the latest 12-month contracts came to a close. The average contracted rate recorded on 15 May stood at $5850 per container, while the average for new agreements running from Q2 2022 to the end of Q1 2023 was even higher, at $5945 per 40-ft. reefer.“This is an almighty increase, pushing prices to an all-time high” said Patrik Berglund, Xeneta CEO.

Xeneta Appoints Finbow, Irvine to Exec Team

Xeneta, a leader in ocean and air freight rate benchmarking, market analytics platform and container shipping index, announced the appointment of two new sales executives. Scott Irvine joins Xeneta as VP of Freight Forwarding and Laura Finbow will serve as Director of Sales Enablement. Scott Irvine has worked in the logistics industry for over two decades holding senior leadership roles across both shippers and freight forwarders. Most recently Scott was the VP of Air & Ocean for Zencargo, a leading digital freight forwarder.

Most Containership Spot Rates Tower Above Long Term Contracts - Xeneta

The Far East to South American East Coast trade is the only front haul trade where the long term is lower than the average spot rate among Xeneta's top 13 trades. Long-term rates on this trade are still below their October highs, but they have been steadily rising since 2022. As of 15 March, long term contracts from the past three months were $800 per FEU above the spot market, at $10,400. In comparison, spot market rates have declined since November 2021, falling from $13,000 to $9…

ZIM Announces Record Financial Year in 2021

Net Income of $4.65 Billion, Adjusted EBITDA of $6.60 billion, and Adjusted EBIT of $5.82 billionAs the containershipping industry enjoys its greatest boom of a generation, ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) announced its consolidated results for the three and 12 months ended December 31, 2021.Net income for the fourth quarter was $1.71 billion (compared to $366 million in the fourth quarter of 2020), a year-over-year increase of 366%, or $14.17 per diluted share…